Peter Chang has a comfortable life — a good income from real estate investments in Oakland and San Francisco, and a home for his family in a tony Lafayette neighborhood.

But when it comes to his approaching retirement, 50-year-old Chang views his prospects in the overpriced Bay Area as bleak. He wants to give up the life he built here and retire in Taiwan, where he’s originally from.

“I don’t think in retirement I can afford this,” he said. “I’m going to have to move away – and I’m actually wealthy. It’s hard to keep up with the rising costs here.”

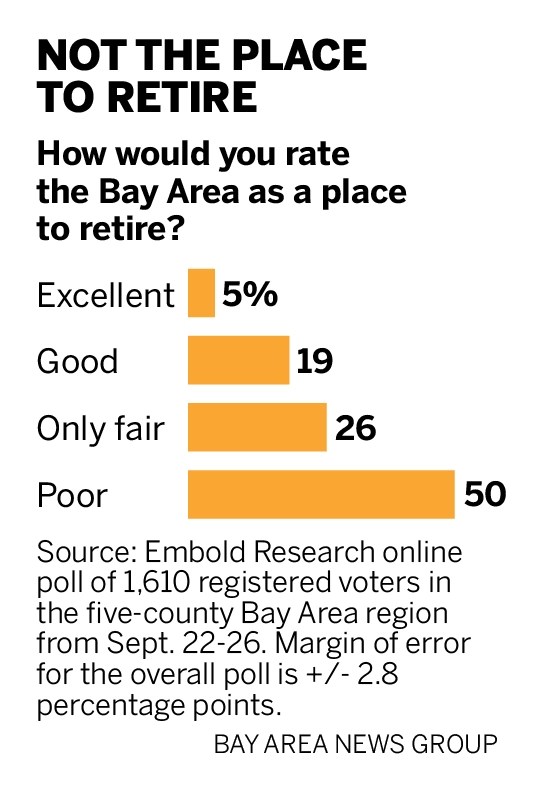

Despite the gorgeous weather, stunning views and top-notch food and entertainment offerings, half of Bay Area residents say the region is a poor place to retire, according to a recent poll by the Bay Area News Group and Joint Venture Silicon Valley. During the COVID-19 pandemic, not having enough money to retire, as well as a general lack of savings, were residents’ top two financial worries — overshadowing concerns about debt, paying for rent or a mortgage, and affording health care.

As the population ages, the result is potentially a disaster in the making. Even relatively high earners like Chang aren’t exempt, though the fallout will be far worse for low-income seniors. Experts fear waves of older residents will be forced to flee the region where they grew up. And some seniors who rely on Social Security already are ending up on the streets.

As the population ages, the result is potentially a disaster in the making. Even relatively high earners like Chang aren’t exempt, though the fallout will be far worse for low-income seniors. Experts fear waves of older residents will be forced to flee the region where they grew up. And some seniors who rely on Social Security already are ending up on the streets.

“I do think that we are starting to see a crisis,” said Nari Rhee, director of the Retirement Security Program at UC Berkeley’s Center for Labor Research and Education, “in terms of seniors not being able to stay in Silicon Valley and the Bay Area.”

Slightly less than a quarter of those polled in the five core Bay Area counties rated this as an excellent or good place to retire. In contrast, 71% said the region is an excellent or a good place to pursue a career. The only thing worse than retiring in the Bay Area is purchasing a house here — 70% of respondents rated the region as a poor place to buy.

Since the start of the pandemic, 40% of residents have worried about having enough money to retire while 39% worried about a general lack of savings. People ages 35 to 64 were especially likely to worry about retirement, and renters worried much more than homeowners.

Russell Hancock, president and CEO of Joint Venture Silicon Valley, said the retirement angst expressed in the poll suggests soaring costs finally have caught up with the region.

“It’s showing deep unrest,” he said, “deep concern.”

Michael Bell, 42, manages a coffee shop in Redwood City. He cashed in his 401K in 2015 to tide him over while he was between jobs, and has had a hard time saving since then.

“I don’t see myself retiring because I just don’t see myself with the ability to even save up for a house,” he said. “So how am I going to save up for a decade or more of not working? That’s crazy.”

Lida S., who didn’t want her full last name used to protect her privacy, withdrew her retirement savings to keep her business afloat during the pandemic. The 53-year-old Concord resident is a broker who helps small business owners sell their companies. Demand for her services dried up thanks to COVID-19 and still hasn’t fully bounced back. Now, she worries daily about what she’ll do and where she’ll go when she’s ready to retire.

“Looking at how expensive our lives are in California compared to the rest of the country, everything from food to gas to housing,” she said, “makes me scared that do I have to keep working until I’m in my 80s? Until I’m in my grave? Where do we go from here?”

It’s a statewide problem. Nearly half of private-sector employees in California have no dedicated retirement assets, according to a 2019 UC Berkeley Labor Center study by Rhee. And Social Security doesn’t keep up with Bay Area rents. Retired workers in the state collected an average of $1,513 per month in Social Security benefits in December. But the median rent for a one-bedroom apartment is $2,329 in San Jose and $1,995 in Oakland, according to apartment rental website Zumper.

Ask Malcolm Jones Jr. if he’ll ever be able to retire, and he just laughs.

“I don’t know,” the Richmond resident said. “I’m tired of working already.”

Even though he’s 72, Jones has no retirement savings and no way to actualize his dream of becoming a full-time grandfather and great-grandfather. A counselor in a Berkeley homeless shelter, Jones got sober at 52 after years of addiction and will probably have to keep working until he physically can’t. What happens to him after that is in God’s hands, he said.

Even among people who have succeeded in retiring here, one-third said it’s a poor place for it. Just 8% of Bay Area retirees said it’s an excellent place.

Pat Scott is in the minority of respondents who think the Bay Area is a good place for retirement. The 78-year-old owns a house in the Oakland hills and stays active skiing, cycling and reveling in the region’s breathtaking scenery. Though it’s expensive – her property taxes alone are over $20,000 a year – Scott is confident she has enough saved.

“If I don’t, I’ll just sell this and move into a smaller apartment,” she said. “That’s all.”

But Matthew McLoone, a 58-year-old retired UPS worker, worries even though he owns a home in Oakland, collects a pension and has a 401K.

“Let’s say I live to 95,” he said. “That’s quite a stretch. It’s concerning.”

People’s race, ethnicity and income levels made little difference in shaping their views of retirement in the Bay Area. Nearly half of people making $250,000 or more view the region as a poor place to retire, and almost a quarter worried about retirement at some point during the pandemic.

Robert McKinley, a 72-year-old airport consultant from San Francisco, was forced into early semi-retirement when COVID-19 shut down most air travel. Though he loves the Bay Area and the daily walks in Golden Gate Park that keep him healthy, he’s constantly toying with the idea of moving somewhere cheaper.

“That’s something I’m juggling with all the time. Do I stay here or do I ultimately make a move?” he said. “It’s just a very expensive place to live.”

For other workers, retirement worries are overshadowed by more immediate concerns.

“To be honest, I don’t even think about retirement at this point. Because, am I going to be able to keep the house? Am I going to be able to get employment?” said 58-year-old Damon Borrelli of Dublin, whose human resources job ended just before the pandemic. When COVID hit, he couldn’t find work and was forced to tap into his 401K.

“So I figure I’m working until 70, 75 if they’ll let me.”

The online poll of 1,610 registered voters in Alameda, Contra Costa, San Francisco, Santa Clara, and San Mateo counties, was conducted by Embold Research for Joint Venture Silicon Valley and the Bay Area News Group in English, Spanish, Chinese and Vietnamese. The poll, conducted Sept. 22-26, has a modeled margin of error of +/- 2.8 percentage points.