Overall, we found that:

• Between 2019 and 2020, the average 401K balance increased by 30.3 percent

• Between 2019 and 2020, the average 401K employee contribution increased by 6.12 percent

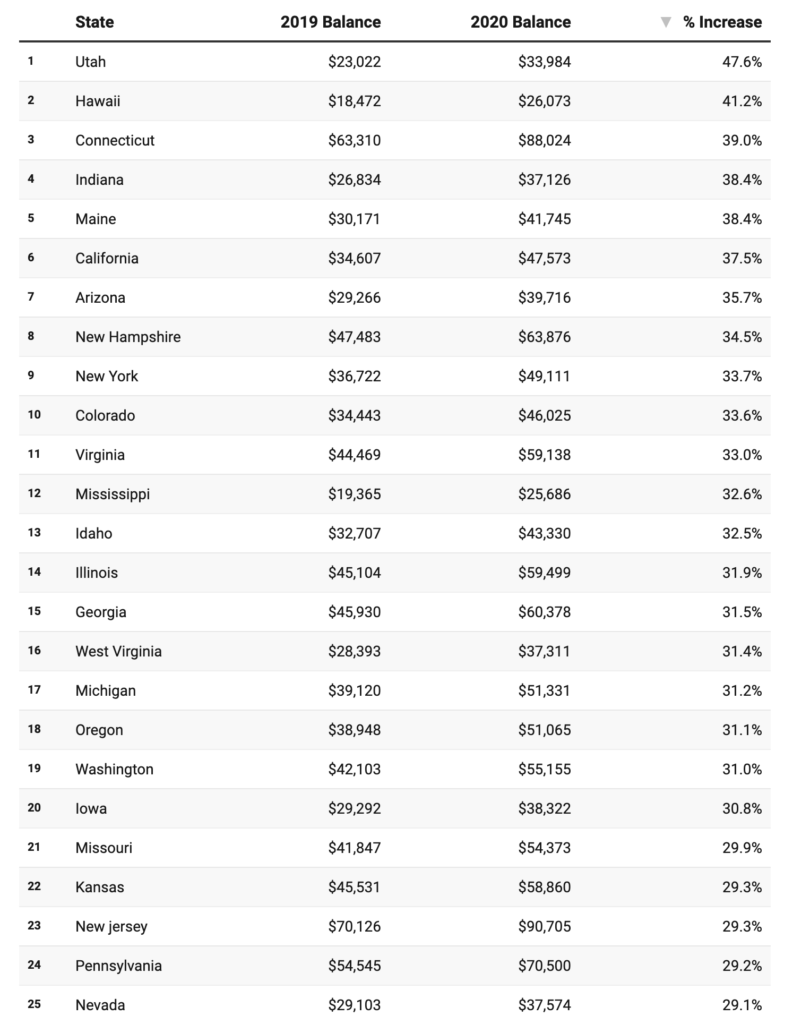

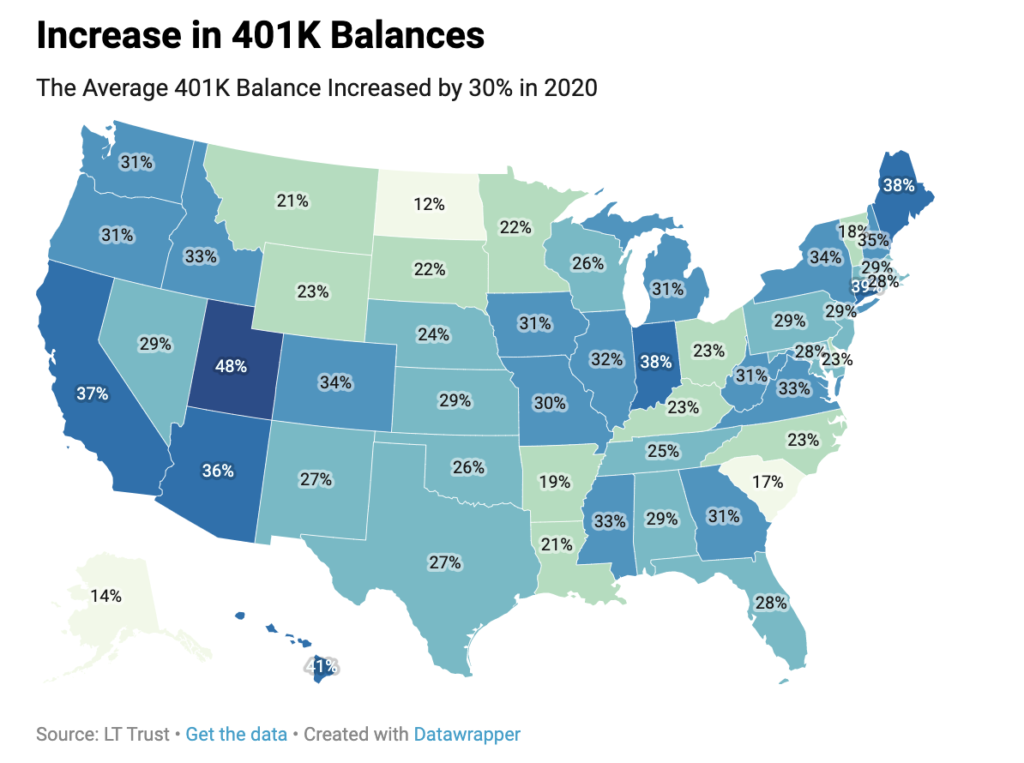

• Utah saw the largest average balance increase at 47.2 percent, while North Dakota saw the lowest uptick at 11.5 percent

• Despite growth across the board, the 401(k) contributions of males increased 3 percent more than their female counterparts

• Employees aged 21-30 saw the largest average balance increase, at 77 percent.

While there is no question that millions of Americans–from business owners and their employees to investors and retirees–have been negatively impacted by the COVID-era economy, 401Ks were, by and large able to weather the 2020 storm. This is likely due to a combination of economic anxieties and fears resulting in larger employee contributions and an increase in disposable income from the shift to remote work (IE fewer trips to the gas station, not as many to-go coffees and restaurant lunches, and far fewer post-work trips for drinks) and the widespread shut downs that left many with nothing to do but stay at home.

As more and more cities, states, and workplaces ease restrictions and open up in 2021, it is worth monitoring whether or not these super saver trends continue or if contributions and balances decrease from 2020.

Top 25 401(k) balance increases by state

The average 401(k) balance increased by 30% in 2020