Every investor wants to retire with enough money to comfortably last them a long lifetime, with plenty leftover to leave to heirs or favorite causes. A diversified, and informed, strategy is the best risk-adjusted method for getting there.

Part of that strategy should be to start early and let the magic of compounding do its thing. Another is to have a mix of growth, value, and dividend-paying holdings. Home Depot (NYSE:HD) is a stock that is backed by a growing business, and one that continues to share its cash flow with shareholders through a sharply increasing dividend. Shares may not always be a bargain, but by holding and reinvesting more along the way, investors can use this stock to retire with the money they need and desire.

Image source: Getty Images.

Looking back 10 years

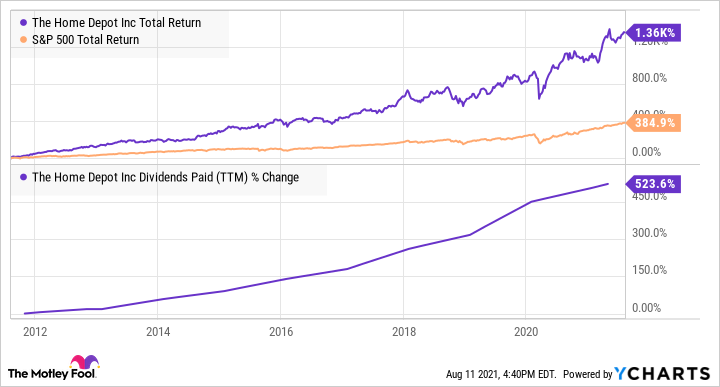

Most investors will need to be invested much longer than 10 years to claim millionaire status. But at least for the last decade, owning Home Depot stock would have given investors a good head start on getting to retirement as a millionaire. Performance of the stock consistently outpaced the S&P 500 index including dividends, which themselves were increased by more than 500% over that time.

HD Total Return Level data by YCharts

That performance was the result of a focus on growing and improving the business. The company isn’t a disruptor with some new technology that could become obsolete by a new product entering a market. It worked on growing its business by utilizing existing technology and taking advantage of trends in the home repair market. The result has been significant cash flow allowing it to continue to reinvest while also returning capital to shareholders both through the dividend and share repurchases.

A successful strategy

Home Depot achieved those results largely by being out in front of demand. It announced a new One Home Depot investment program in 2017 that consisted of a multi-year plan for an $11 billion investment to build the company’s online channels and merge the digital and physical shopping experience for customers. That began paying off even prior to the pandemic, but was extremely successful in taking advantage of the surge in home remodeling in 2020 during the pandemic.

The company also acquired HD Supply, a supplier of maintenance, repair, and operations products, in an $8 billion deal announced in late 2020 to refocus on the professional contractor base.

The results have been phenomenal over the last year. For fiscal 2020, revenue increased 19.9% versus fiscal 2019. Comparable sales for the year also increased about 20% overall, and slightly higher in the U.S. That success has continued into 2021. In this year’s first-quarter period ended May 2, sales soared 33% over the prior-year period.

And management continues to innovate. It has 1,300 rental locations and just launched a “rent online, pick-up in store” program in June. The program has been rolled out across North America. According to Richard Porter, vice president of The Home Depot Rental, it allows both professional and do-it-yourself customers to “conveniently check equipment availability and reserve what they need in advance to get in and out of our rental centers more quickly than ever.”

Riding it into retirement

The new program shows Home Depot management isn’t content with sticking to the status quo. And it plans to continue to share the success with investors. In May 2021, the company declared a dividend that will be the 137th consecutive quarter the company has paid a cash dividend. That payment represents a 10% increase over the prior-year quarterly dividend. Home Depot also authorized a new $20 billion share repurchase program.

Home Depot next reports earnings for its fiscal second quarter on Aug. 17. Investors at any age who don’t yet own shares should consider monitoring the release and researching whether the stock fits their portfolio. Chances are it has a place and can be a stock that could help make an investor a millionaire by retirement.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.