-

Manulife survey reveals healthier, fitter lifestyle habits across Asia

-

Greater appetite in the region to buy new insurance as digital trends accelerate

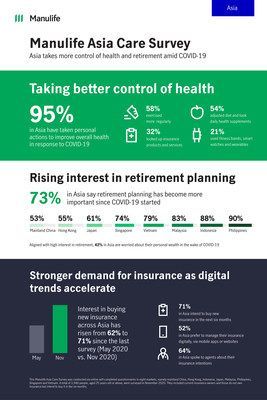

HONG KONG, Feb. 4, 2021 /PRNewswire/ — A year on from Covid-19 first entering the public consciousness, people across Asia are taking more control of their health and retirement planning, as they look to the pandemic’s longer term impact on their personal wealth and lifestyle habits, according to new research from Manulife.

The latest version of the “Manulife Asia Care Survey” takes a deep dive look into customers’ concerns, priorities and aspirations amid the pandemic. The survey, which was conducted in November 2020, polled some 4,000 people, across eight markets in Asia, covering mainland China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore and Vietnam.[1]

Nearly all of the respondents (95%) across Asia who worry most about Covid-19 have taken personal actions to improve their overall health, mainly through more regular exercise and improved diet, particularly in the emerging markets.[2] Additionally, no matter their views on Covid-19, almost all respondents (92%) are tracking a series of health and fitness measures, including body weight, sleep quality, blood pressure, heartbeat and steps.

Almost three out of four respondents (73%) say retirement planning has become more important since Covid-19 started.[3] This high level of interest is aligned with concerns about personal wealth. Across all markets, 42% are worried about their personal wealth in the wake of Covid-19, with respondents in Hong Kong and Singapore the most concerned.

Stronger demand for insurance protection as digital trends accelerate

Aligned with taking better control of health and finance, interest in buying new insurance across Asia has risen from 62% to 71% since the last survey.[4] Respondents were most interested in life, health and critical illness products. Over half (52%) say they prefer to manage their policies through digital means like mobile apps, including for claims and payment, while insurance agents are still in high demand, with 64% of the respondents saying they have spoken with agents about their insurance intentions.[5]

“Health and retirement have clearly become more important for our customers since the onset of Covid-19,” said Anil Wadhwani, CEO and President of Manulife Asia. “What this survey shows is that, amid uncertainty, people are finding ways to take more control of their health and financial planning agendas, including through the adoption of digital. In many ways, the pandemic has fast-tracked digitisation, and those digital habits are here to stay. We are responding to these trends with simpler, customer-centric insurance and wealth solutions, new digital tools for customers and agents, and behaviour-linked programmes like ManulifeMOVE, which can all help make every day better in meaningful ways for our customers.”

|

[1] This version of the Manulife Asia Care Survey was conducted via online self-completed questionnaires in eight markets, namely mainland China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore and Vietnam. A total of 3,946 people, aged 25 years old or above, was surveyed in November 2020. They included insurance owners and those who did not own insurance but intended to buy it in the next six months. |

|

[2] Among the respondents who are most concerned with Covid-19, Indonesia (74%), Vietnam (72%), Philippines (69%) and Malaysia (57%) say they are exercising more regularly, compared to mainland China (52%), Hong Kong (42%), Singapore (38%) and Japan (30%). |

|

[3] The retirement planning figure is highest in emerging markets, where respondents in the Philippines (90%), Indonesia (88%), Malaysia (83%) and Vietnam (79%) all viewed retirement planning as much more important or important. Figures in the other markets: Singapore (74%), Japan (61%), Hong Kong (55%) and mainland China (53%). |

|

[4] The previous Manulife Asia Care Survey was conducted in May 2020. For more information, refer to: https://www.manulife.com/en/news/covid-19-anxieties-prompt-healthier-fitter-lifestyles-in-asia.html. |

|

[5] Manulife has introduced non-face-to-face capabilities across Asia, allowing agents and customers to meet virtually and close sales digitally. Customers can submit claims electronically and discuss their financial needs with agents through video conferencing via encrypted networks. |

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. With our global headquarters in Toronto, Canada, we operate as Manulife across our offices in Canada, Asia, and Europe, and primarily as John Hancock in the United States. We provide financial advice, insurance, and wealth and asset management solutions for individuals, groups and institutions. At the end of 2019, we had more than 35,000 employees, over 98,000 agents, and thousands of distribution partners, serving almost 30 million customers. As of September 30, 2020, we had $1.3 trillion (US$943 billion) in assets under management and administration, and in the previous 12 months we made $31.2 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 155 years. We trade as ‘MFC’ on the Toronto, New York, and the Philippine stock exchanges and under ‘945’ in Hong Kong.

SOURCE Manulife