Overview

Contents

For nontraditional workers, the biggest barrier to retirement savings is lack of a workplace plan. Workplace retirement plans make saving easier, for example, by automating contributions so the worker doesn’t have to remember to save. Employer-provided defined contribution (DC) plans also frequently use behavioral nudges, such as auto-enrollment and default contribution rates, to help workers build their savings.

To help understand nontraditional workers’ access to retirement savings plans, the barriers they face to saving, and possible solutions, The Pew Charitable Trusts in 2020 surveyed 1,000 workers who said they did nontraditional work (sometimes known as contingent, gig, or independent work) either as a primary job or in combination with other traditional or contingent jobs.

Pew’s survey showed that roughly half (46.3%) of contingent workers had an employer during the previous year that offered any type of retirement plan, with access to a plan being strongly tied to having a traditional job in addition to nontraditional work.1 Fewer still were eligible for a workplace plan or chose to participate in one:

Just 21.9% of the survey’s nontraditional workers participated in a DC plan, such as a 401(k), at their current workplace(s) during the year leading up to the survey.2 The many workers without employer-provided retirement plans risk entering retirement without adequate savings, or they may be unable to retire.

But workers in a marriage or partnership may be able to save for retirement even if they do not have a retirement plan at their own job. As an example, one member in a household might work in traditional employment

with retirement and other benefits while the other member follows an entrepreneurial path that doesn’t offer employer-provided benefits. Thus, a spouse or partner’s job can be a potential point of access to a workplace retirement savings for the whole household.

Do coupled relationships reduce the retirement plan access gap for nontraditional workers? This report examines those in a partnership or marriage to better understand spouse or partner participation in workplace plans and whether couples coordinate their savings.

Key findings:

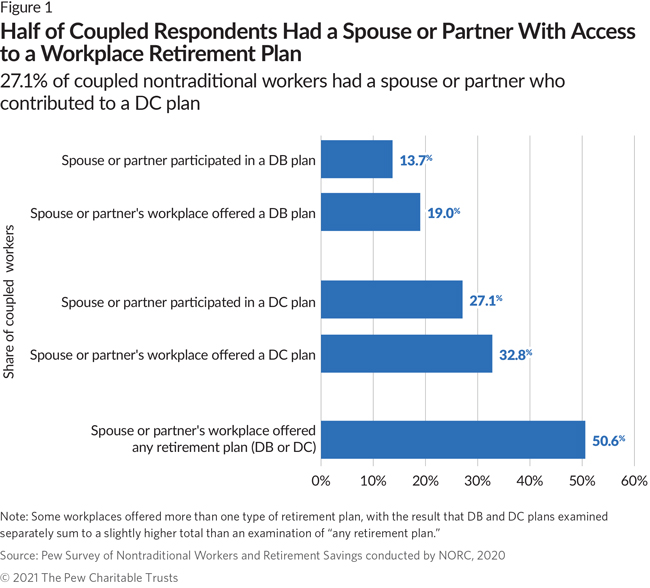

- Just 1 in 4 nontraditional workers had access to retirement benefits through a partner or spouse; 56% of nontraditional workers were married or living with a partner, and half of these coupled workers (50.6%) had a spouse or partner whose workplace offered a traditional defined benefit (DB), DC, or other type of retirement plan, such as an annuity.3

- Thanks to a spouse or partner’s workplace plan, overall access to a workplace plan increased by 11.8 percentage points among all (coupled and single) nontraditional workers, from 46.3% to 58.1%. A large proportion of spouses and partners take advantage of this access: 82.6% saved in a DC plan and 71.9% participated in a DB plan, when offered.

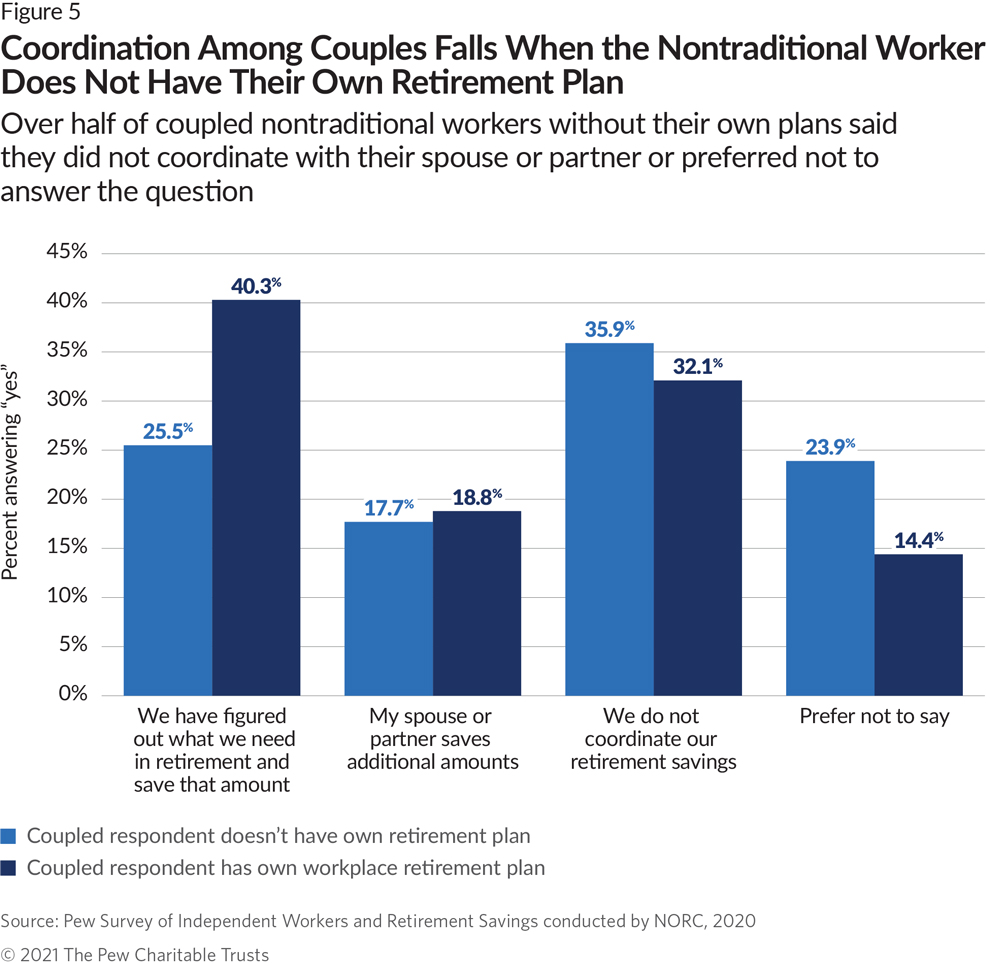

- Just 25.5% of married or partnered contingent workers without their own workplace plans reported that they had figured out what they need for a secure retirement and coordinate with their spouse or partner to save accordingly.

- Ten percent of coupled respondents said they don’t know whether their spouse or partner had a retirement plan, a likely marker of low coordination within a household.

- Coordination by couples may improve access and retirement savings for some, but it is unlikely to prove a solution for all or even most nontraditional workers, given that nearly half are uncoupled, and even among coupled workers, the increase to access is relatively low and coordination among spouses and partners is poor.

This report is one of a series using Pew’s survey of nontraditional workers to examine their retirement security. Pew has also explored nontraditional workers’ access to workplace retirement plans,4 the barriers and obstacles that nontraditional workers face in saving for retirement,5 their retirement savings balances at work and in IRAs,6 and nontraditional work during the pandemic.7 Subsequent reports will explore survey results to look at nontraditional workers’ understanding of financial concepts and skills, and which types of retirement savings programs appeal to different groups of nontraditional workers.8

Spousal access and participation in workplace retirement plans

Roughly half (46.3%) of survey respondents had a job during the previous year that offered a retirement plan, such as a DB or DC plan, or another type of retirement plan, such as an annuity.9 Among coupled nontraditional workers, 21.4% did not have their own workplace retirement plan but had a spouse or partner who did. Couples who coordinate their financial decisions could take advantage of this increased access to save more, lowering the risk they will enter retirement without adequate savings.

About half (50.6%) of married or partnered respondents had a spouse or partner whose workplace offered any type of retirement plan, including 32.8% who were offered a DC plan and 19.0% who were offered a DB plan (with some overlap when spouses were offered both). (See Figure 1.) Spouses and partners contribute to a workplace retirement plan when offered: 82.6% saved in a DC plan when offered, and 71.9% participated in a DB plan (not shown).10 As a result, 27.1% of coupled nontraditional workers had a spouse or partner who contributed to a DC plan and 13.7% had a spouse or partner who participated in a DB plan.

But an important share of coupled respondents—10.4%—said they didn’t know whether their spouse or partner had any type of workplace retirement plan. Couples may not always share this information with each other.11 Additionally, previous research by Pew showed that many workers were inattentive to their own workplace retirement plans—31% were not at all familiar with the fees they were paying to investment managers for their own plans—so it may not be surprising that workers were unfamiliar with whether a spouse or partner had a workplace plan.12

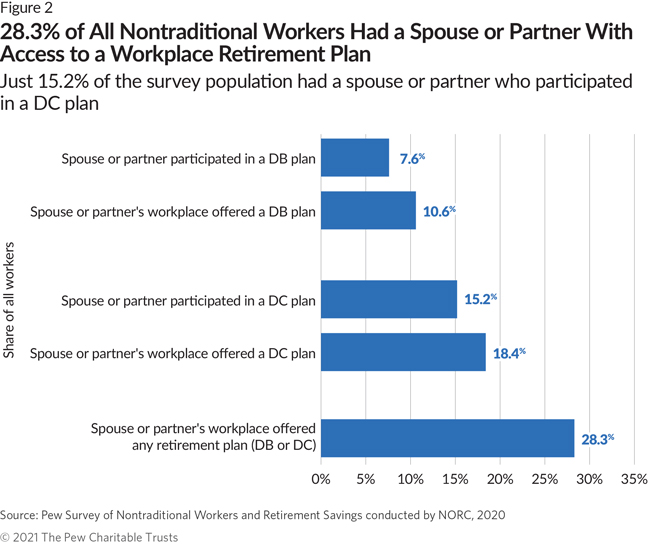

With 44% of survey participants not married or living with a partner, access to a plan through a spouse or partner has a lessened effect on overall access rates. Looking at the entire population, coupled and uncoupled, 28.3% of all nontraditional workers had a spouse or partner whose workplace offered any type of retirement plan. (See Figure 2.) Access and participation varied by type of plan. Just 15.2% of all respondents had a spouse or partner who participated in a workplace DC plan, and even fewer—7.6%—had a spouse or partner who participated in a workplace DB plan.

Overall, nontraditional workers’ access to a workplace retirement plan increased by 11.8 percentage points, from 46.3% to 58.1%, thanks to a spouse or partner’s plan.

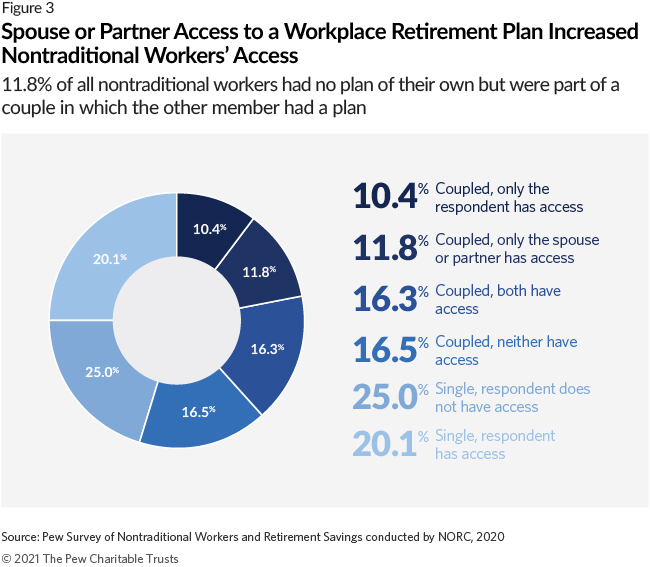

Many respondents did have access to their own retirement plans, including 20.1% of all nontraditional workers who were single, 10.4% who were coupled and only the respondent had access, and 16.3% in which both members of a couple had access. Still, 41.4% of all nontraditional workers still lacked a workplace plan, including 25% who were single workers without a plan and 16.4% who were part of a couple in which neither member had access.

Spouse and partner contributions to DC plans

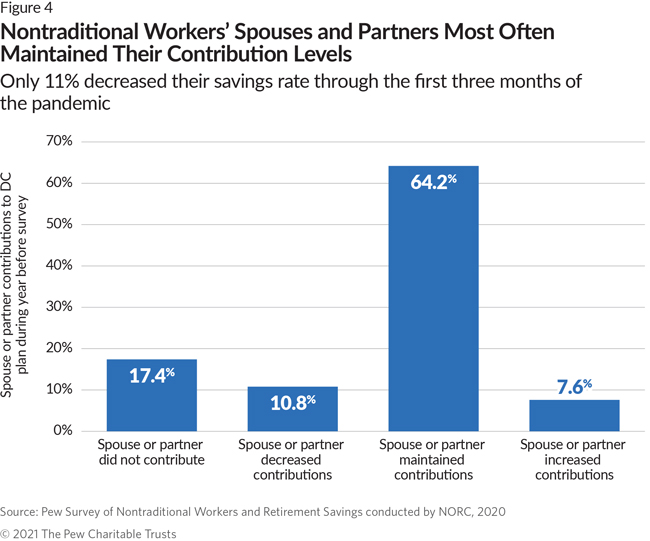

Pew fielded this survey in June 2020, the last month of the second quarter of that year, when real gross domestic product (GDP) fell by 31.4% (annualized) as a result of business and individual responses to the COVID-19 pandemic.13 Not surprisingly, some American families found it necessary to reduce their contributions to DC plans or to stop contributing altogether.

Pew’s survey asked respondents if their spouse or partner’s retirement plan contributions had increased, decreased, or stayed the same over the past 12 months.14 Because the survey question asked about contribution behavior over the past year, before the onset of the pandemic, we cannot say with certainty that any changes in contributions are due to the pandemic, but it is possible that the pandemic influenced some of the responses. The most common DC contribution pattern among spouses and partners of nontraditional workers was to maintain their existing contribution rate through the year before the survey, but 28.2% either reduced their contributions or did not contribute at all. (See Figure 4.) The high number of responses of maintaining or even increasing contributions suggests that many households may have weathered the economic downturn related to the pandemic well, at least in its early stages.

Coordination within couples

Beyond the access and participation queries described above, the Pew survey also explored whether couples explicitly work together in planning for a secure financial future. When one member of a household has no workplace retirement plan and the other does, the couple may decide to use more of the former’s earnings for everyday expenses and bills, and save more out of the latter’s earnings.

Nontraditional workers didn’t always take advantage of a spouse or partner’s workplace retirement plan, however. As discussed above, 10.4% of respondents did not know whether their spouse or partner even had a plan. When coupled respondents without their own plans were asked to describe how they approached saving for retirement, 25.5% said they had figured out what they will need in retirement and are saving accordingly, and 17.7% said their spouse or partner saved additional amounts for the two of them; this survey question offered the opportunity to make multiple choices, and there is likely some overlap between these responses. (See Figure 5.) But 35.9% of coupled respondents without their own plan said they did not coordinate retirement savings with their spouse or partner and 23.9% preferred not to answer the question.15

Nontraditional workers with access to their own plan were more likely, relative to other coupled workers, to say that they were saving what they needed for retirement (40.3%), or that their spouse or partner was saving additional amounts (18.8%). An implication of these findings is that coupled households in which one or both members have a retirement plan are much more likely to figure out what they need for retirement and coordinate savings; for example, married workers are more likely than those who were never married or who are living with a partner to plan for retirement. As noted in prior work by Pew, retirement plan access may therefore provide benefits to participants beyond just an opportunity to save.16

Conclusion

Access to a workplace retirement savings plan through a spouse or partner’s job may allow some workers to save additional amounts, or even to save enough for a secure retirement. But this is likely not a viable strategy for most nontraditional workers, only 56.0% of whom are married or living with a partner. Overall access to a retirement plan increases by just 11.8%, looking across all nontraditional workers, coupled and uncoupled, when spousal or partner access is included.

Couples in which one partner has access to a workplace plan may coordinate to save additional amounts. Unfortunately, the survey results suggest that less than half of coupled nontraditional workers are coordinating with their spouse or partner to save more or enough for a secure retirement.

In sum, access to retirement savings through a spouse or partner’s plan will not be enough to ensure retirement security for the many nontraditional workers who lack their own workplace retirement plans. This finding is further evidence that nontraditional workers need a variety of solutions that provide retirement savings opportunities directly and efficiently to all workers. If given the opportunity, many workers will save.17

Future work from this Pew survey will explore in more depth some alternative approaches to retirement saving, such as saving through the tax system, a financial institution, or a fintech app. Additional options may include state-facilitated auto-IRA programs, which enroll private sector workers in a savings plan when they do not have a workplace plan, and which could potentially be adapted to include nontraditional workers. It’s likely that more than one solution is needed to address the varied needs of this diverse segment of the labor force.

Methodology

The Pew Charitable Trusts hired NORC at the University of Chicago to survey nontraditional workers to better understand their access to retirement savings plans through work or outside of work and decisions they made about saving for retirement. The sample was drawn from NORC’s nationally representative AmeriSpeak Panel. The survey was fielded online and by telephone, in English and Spanish, from June 4, 2020, to July 1, 2020. The survey obtained 1,026 qualified interviews from individuals ages 18 and over who worked in nontraditional jobs (also referred to as gig, nonstandard, or independent jobs). Quotas were used to ensure enough completed surveys for three subtargets: workers with a single nontraditional job, workers with a mix of traditional and nontraditional jobs, and workers with multiple nontraditional jobs (but no traditional job). Survey results were weighted to reflect the selection probabilities of the panel members as well as weighting adjustments to ensure that the weighted panel represented the U.S. household population. The study sample supports proportion estimates with a margin of error no greater than 4.26 percentage points.

For more information on methods, see the survey Methodology statement18 and Topline Results.19

Endnotes

- The Pew Charitable Trusts, “Nontraditional Workers Lack Access to Workplace Retirement Options” (2021), https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2021/10/nontraditional-workers-lack-access-to-workplace-retirement-options.

- A defined contribution plan is a type of retirement plan in which a worker contributes a percentage or a share of her paycheck to an account that is held in her name. Employers generally contribute matching percentages to defined contribution plans as an incentive to participate, the accounts are intended to be used in retirement, and restrictions apply to pre-retirement withdrawals.

- Defined benefit plans provide a fixed benefit for employees at retirement. The benefit is often determined by a formula that incorporates salary and number of years of service.

- The Pew Charitable Trusts, “Nontraditional Workers Lack Access to Workplace Retirement Options.”

- The Pew Charitable Trusts, “Nontraditional Workers Face Multiple Barriers to Saving for Retirement” (2021), https://www.pewtrusts.org/en/research-and-analysis/articles/2017/12/retirement-savings-barriers-to-savings.

- A. Shelton, “Freelancers, Sole Proprietors, and Other Nontraditional Workers Have Little Retirement Savings,” The Pew Charitable Trusts, July 13, 2021, https://www.pewtrusts.org/en/research-and-analysis/articles/2021/07/13/freelancers-sole-proprietors-and-other-nontraditional-workers-have-little-retirement-savings.

- A. Shelton, “More Than 40% of Nontraditional Workers Had Hours Cut or Lost Jobs Because of COVID-19,” The Pew Charitable Trusts, April 23, 2021, https://www.pewtrusts.org/en/research-and-analysis/articles/2021/04/21/more-than-40-of-nontraditional-workers-had-hours-cut-or-lost-jobs-because-of-covid-19.

- The Pew Charitable Trusts, “Nontraditional Workers and Retirement Security—Potential Solutions” (Forthcoming).

- The Pew Charitable Trusts, “Nontraditional Workers Lack Access to Workplace Retirement Options.”

- Take-up among survey participants themselves was 77.5% when a DC plan was offered. See The Pew Charitable Trusts, “Nontraditional Workers Lack Access to Workplace Retirement Options”

- Eight percent of respondents with a spouse or partner who had a DC plan did not know whether the spouse or partner contributed to it or preferred not to say. And 12.6% of respondents with a spouse or partner who had a DB plan did not know whether the spouse or partner participated in it or preferred not to say.

- The Pew Charitable Trusts, “Many Workers Have Limited Understanding of Retirement Plan Fees” (2017), https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/11/many-workers-have-limited-understanding-of-retirement-plan-fees.

- U.S. Bureau of Economic Analysis, “Gross Domestic Product (Third Estimate), Corporate Profits (Revised), and GDP by Industry, Second Quarter 2020,” news release, Sept. 30, 2020, https://www.bea.gov/news/2020/gross-domestic-product-third-estimate-corporate-profits-revised-and-gdp-industry-annual.

- For findings on nontraditional workers’ experience with retirement plans over the year prior to the survey, see A. Shelton, “More Than 40% of Nontraditional Workers Had Hours Cut or Lost Jobs Because of COVID-19.”

- Workers who preferred not to disclose whether they coordinated with a spouse or partner were disproportionately living with a partner (compared to married workers), Hispanic, in irregular or seasonal employment, or had one or more contingent jobs but no traditional job.

- The Pew Charitable Trusts, “Survey Highlights Worker Perspectives on Barriers to Retirement Saving” (2017), https://www.pewtrusts.org/en/research-and-analysis/reports/2017/09/survey-highlights-worker-perspectives-on-barriers-to-retirement-saving.

- The Pew Charitable Trusts, “Nontraditional Workers Lack Access to Workplace Retirement Options.”

- The Pew Charitable Trusts, “Methodology: Survey of Nontraditional Workers (Also Known as Contingent, Independent, or Gig Workers),” (2020), https://www.pewtrusts.org/-/media/assets/2021/04/methodology_survey_of_nontraditional_workers.pdf.

- The Pew Charitable Trusts, “Pew Survey of Nontraditional Workers and Retirement Savings: Topline Results,” accessed Aug 10, 2021, https://www.pewtrusts.org/-/media/assets/2021/04/pew-survey-of-nontraditional-workers-and-retirement-savings-topline-results.pdf.